What Are Management Fees?

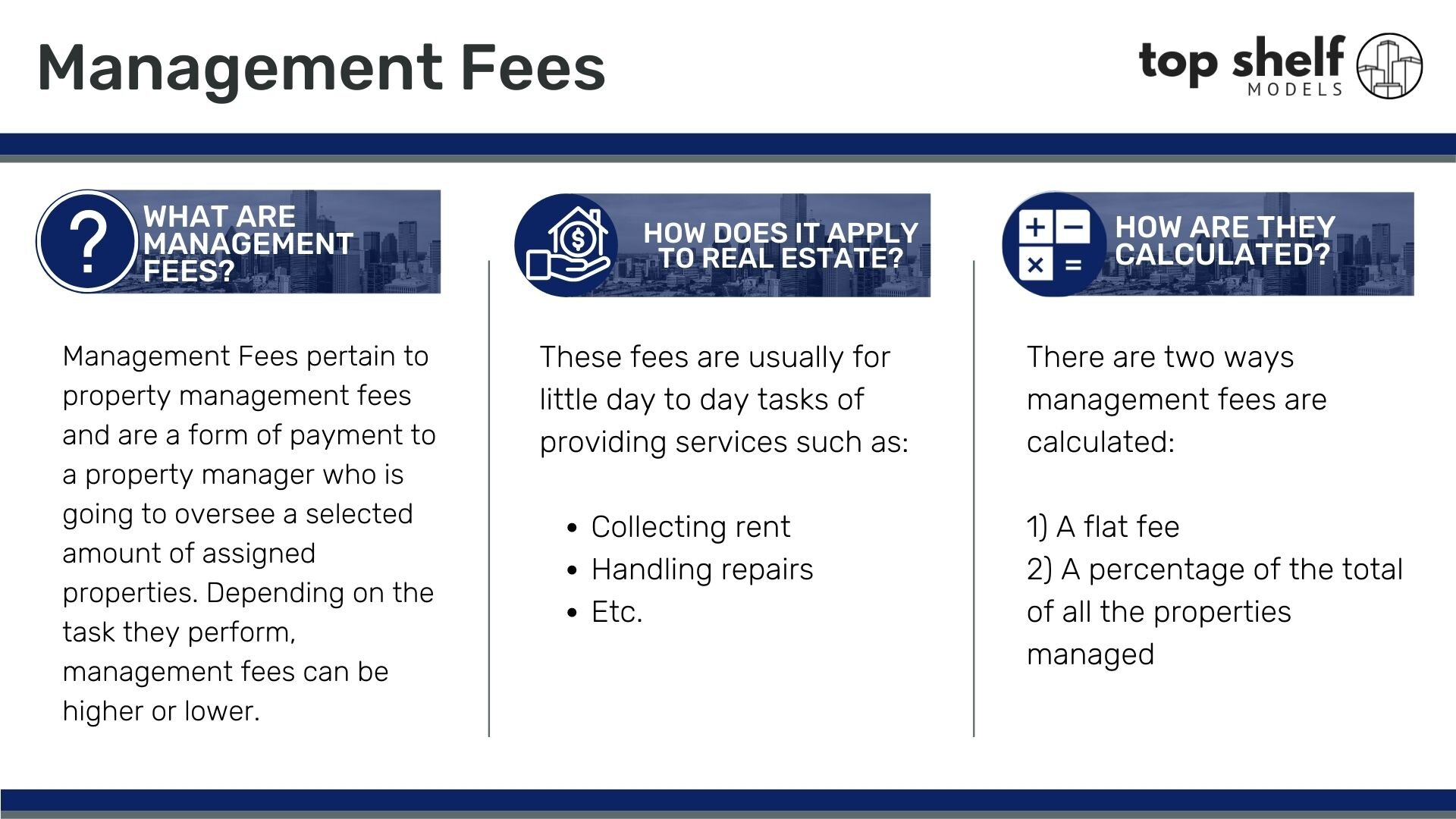

Traditionally in real estate, Management Fees often pertain to Property Management Fees. Management Fees are the form of payment to a property manager who oversees a selected amount of assigned properties and depending on the amount of tasks performed, the Management Fee can be higher or lower. These fees cover the day-to-day operations of managing properties by providing services such as: collecting rent from tenants, handling repairs, filling vacancies, evicting tenants, or keeping track of financial records for tax purposes.

Management Fees are typically calculated from a percentage of the cumulative total of all the monthly rent of properties under management however, they can also be calculated as a flat fee. Traditionally, the fee is somewhere between 8-12% of the gross monthly rent however the larger the amount of properties managed, the lower the percentage will be. For example, smaller residential property management fees would be around 10% or more while a commercial property manager with 10+ units would charge a fee between 4-7%.