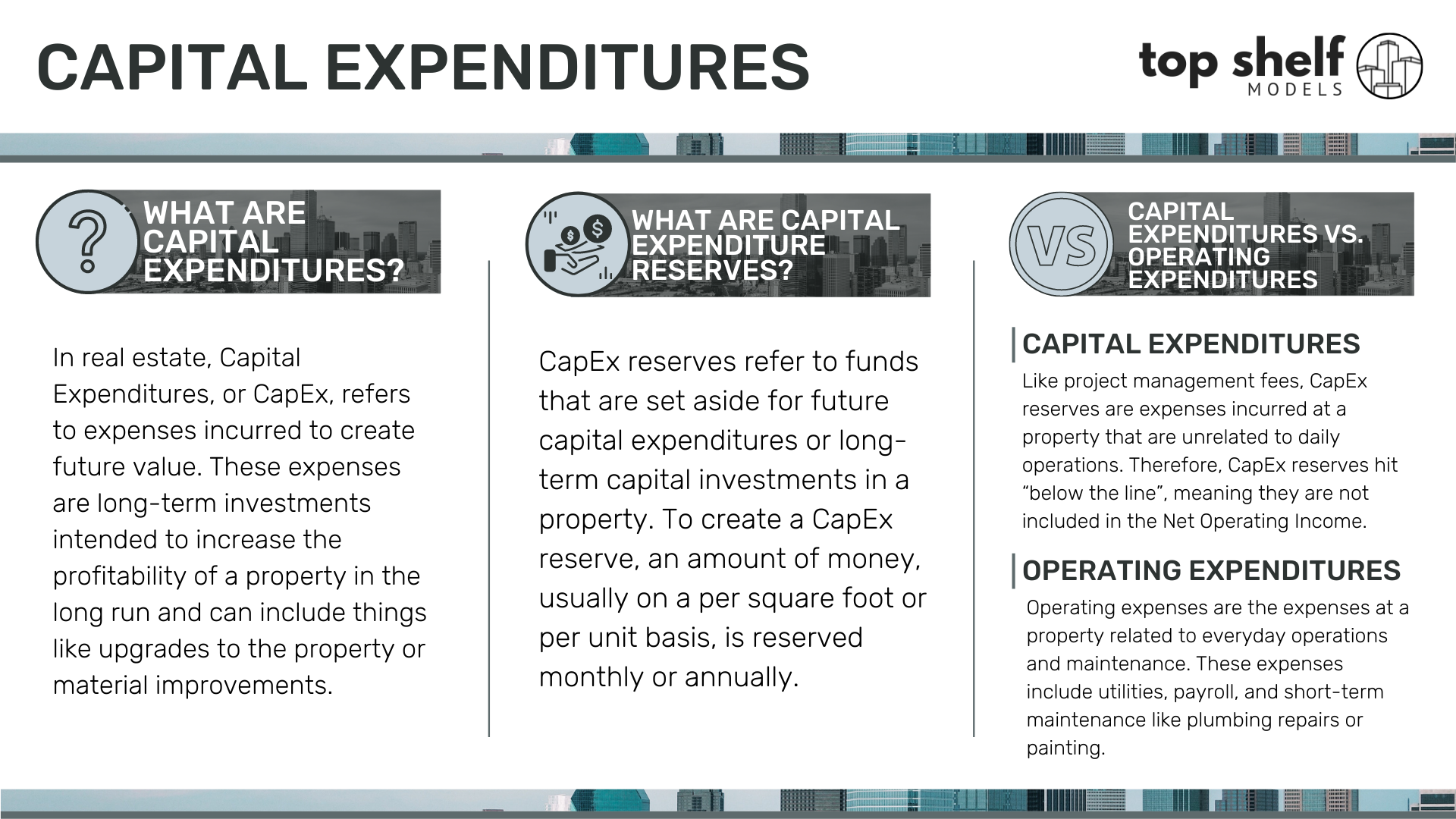

What are Capital Expenditure Reserves?

CapEx reserves refer to funds that are set aside for future capital expenditures or long-term capital investments in a property. To create a CapEx reserve, an amount of money, usually on a per square foot or per unit basis, is reserved monthly or annually.

CapEx reserves are sometimes required by lenders. For example, a lender may require that an office investor set aside $30 per square foot annually to prepare for future capital improvements. Another example of a CapEx reserve is a multifamily investor budgeting $25 per unit monthly to cover future improvements to the units.

CapEx reserves serve as a way for investors to reserve current cashflow so that they can fund future property updates and material investments as needed without the need to call capital or make equity contributions into the investment.