Cash on Cash Returns

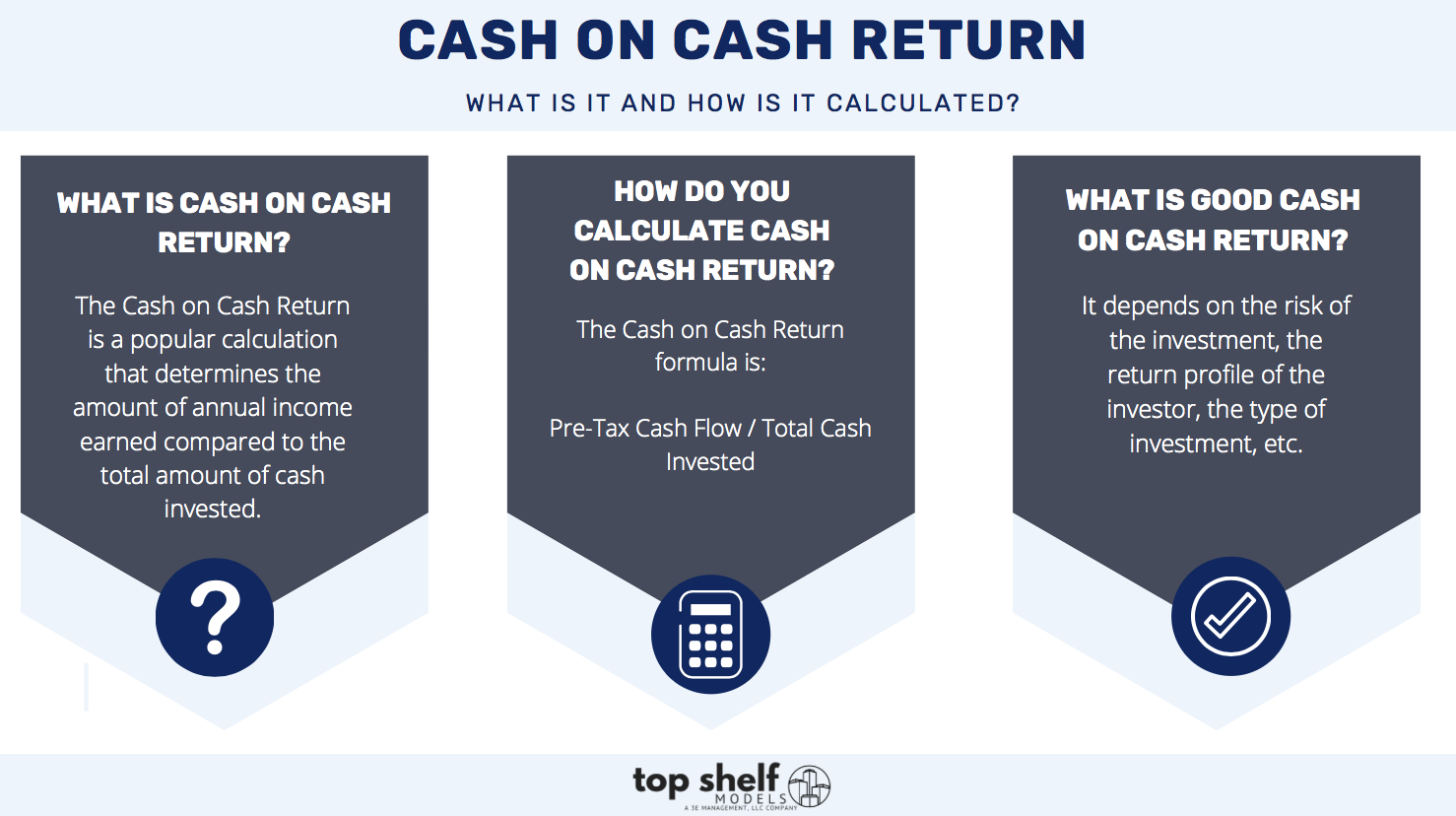

What is Cash on Cash Return?

The Cash on Cash Return is a popular calculation that determines the amount of annual income earned compared to the total amount of cash invested. It differs from the IRR because the Cash on Cash return calculation does not factor in time-value of money. The Cash on Cash differs from the equity multiple or return on investment (ROI) because the Cash on Cash only looks at cash from operations and doesn’t project a terminal or sale value.

Cash on Cash Return Formula

The Cash on Cash Return formula is:

Pre-Tax Cash Flow / Total Cash Invested

Pre-Tax Cash Flow = Revenues – Expenses – Debt Service

Total Cash Invested = Equity Invested into the Investment Pre-Tax Cash Flow

Pre-Tax Cash Flow could be comprised of the following categories, depending on the property type:

Gross Rental Revenue: Revenue received from tenants before reducing for expenses.

Other Income: Other income that isn’t included in Gross Rental Revenue. This could include parking, utility income, antenna, billboard, ATM, etc.

Vacancy: Whether you are using actual vacancy percent or a general vacancy factor, you will need to reduce the income by this amount.

Concessions: Free rent, employee units, or other reductions to income on a temporary basis.

Bad Debt: Allowance for tenants not paying rent.

Operating Expenses: Includes all the expenses to operate the property. These may include repairs & maintenance, administrative, security, utilities, advertising, payroll, other, real estate taxes, franchise tax, insurance, management fees, etc.

Debt Service: Annual amount of principal and interest on the loan.

Total Cash Invested

Total Cash Invested could be comprised of the following categories, depending on the property type:

Down Payment: Amount of equity invested at the closing of the investment.

Closing Costs: Per the closing statement – could include legal, title, pro-rations, etc.

How to Calculate Cash on Cash Return

Let’s look at two examples of how to calculate the Cash on Cash Return. We will assume you purchase the investment at a going-in cap rate of 5.5%.

1. Unlevered (without debt)

Purchase Price: $10,000,000

Debt: $0

Closing Costs (2%): $200,000

Rehab Cost: $1,800,000

Total Cash Invested: $10,000,000 + $200,000 + $1,800,000

Total Cash Invested: $12,000,000

We can determine the Net Operating Income (NOI) by using the 5.5% going-in cap rate assumption.

Purchase Price: $10,000,000

Going-in Cap Rate: 5.5%

Year 1 NOI: $10,000,000 x 5.5%

Year 1 NOI: $550,000

Cash on Cash Return (Year 1):

Year 1 NOI: $550,000 / Total Cash Invested: $12,000,000 = 5.0%

2. Levered (with debt)

Purchase Price: $10,000,000

Debt: ($6,000,000)

Closing Costs (2%): $200,000

Rehab Cost: $1,800,000

Debt Fees (1.5%): $90,000

Total Cash Invested: $10,000,000 - $6,000,000 + $200,000 + $1,800,000 + $90,000

Total Cash Invested: $6,090,000

We can determine the Net Operating Income (NOI) by using the 5.5% going-in cap rate assumption.

Purchase Price: $10,000,000

Going-in Cap Rate: 5.5%

Year 1 NOI: $10,000,000 x 5.5%

Year 1 NOI: $550,000

Year 1 Debt Service (6% Interest): ($360,000)

Year 1 Pre-Tax Cash Flow: $550,000 - $360,000

Year 1 Pre-Tax Cash Flow: $190,000

Cash on Cash Return (Year 1):

Year 1 Pre-Tax Cash Flow: $190,000 / Total Cash Invested: $6,090,000 = 3.0%

All of the TSM Financial Model templates have the Cash on Cash Return already calculated so you don’t need to worry about calculating these formulas in our models.

What is a Good Cash on Cash Return?

We get asked this question a lot and the answer is… it depends. It depends on the risk of the investment, the return profile of the investor, the type of investment, etc. Generally, a Cash on Cash Return of 8%+ is considered good for most investors.

Should You Invest in an Investment with a low Cash on Cash Return?

Possibly. For example, if you invest in an opportunistic fund, then the Cash Flow will be small or even negative until the exit occurs which causes those investors to not pay too much attention to this calculation. You may still achieve a good IRR and multiple, but the Cash on Cash Return calculation will not be a good indicator of the returns. The Cash on Cash Return does not factor in appreciation of the investment or any tax benefits you may receive either.

Cash on Cash Return Formula – The Good

The positives of the Cash on Cash Return are as follows:

Widely used and understood by investors and lenders

Very important to investors seeking regular distributions from cash flow

Easy to see impact of leverage on the calculation

Easier to understand compared to the IRR

Way to conduct back of the envelope calculations to see feasibility of project before performing a full underwriting

Cash on Cash Return Formula – The Bad

The negatives of the Cash on Cash Return are as follows:

Doesn’t consider time value of money like an IRR does

Doesn’t consider real estate appreciation and the value returned at the exit

Only analyzes pre-tax cash flows and not the impact of tax incentives