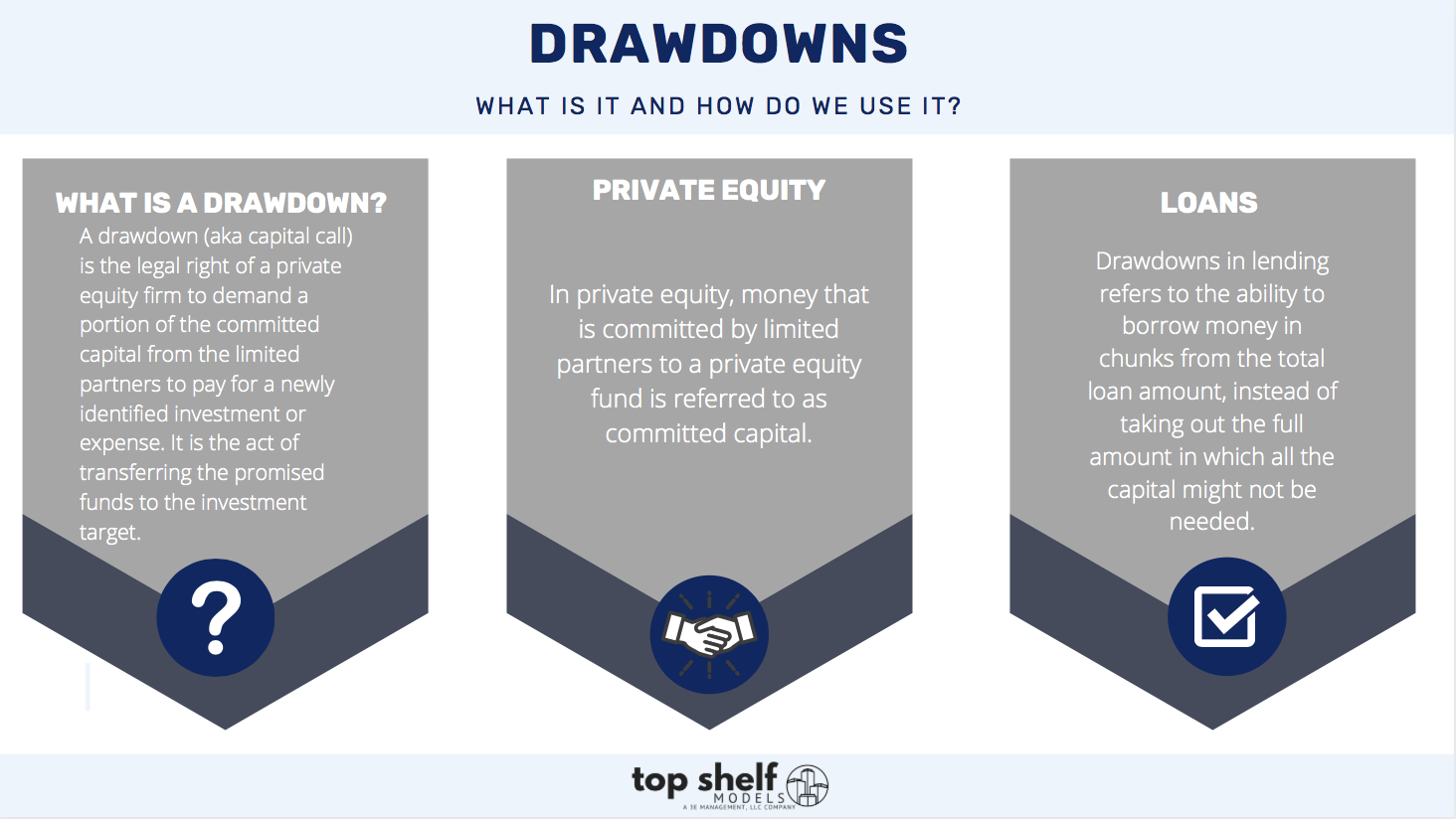

Loans:

Drawdowns in lending refers to the ability to borrow money in chunks from the total loan amount, instead of taking out the full amount in which all the capital might not be needed. These are commonly seen in construction projects, tenant improvements for office buildings, etc. Usually, the equity portion of the total capital is utilized before drawdowns from the loans begin. Drawdown loans provide the reassurance of having access to more money in the future if needed.

EXAMPLE:

Here is an example of a drawdowns (proceeds) in the multifamily development model from Top Shelf Models: