Conclusion

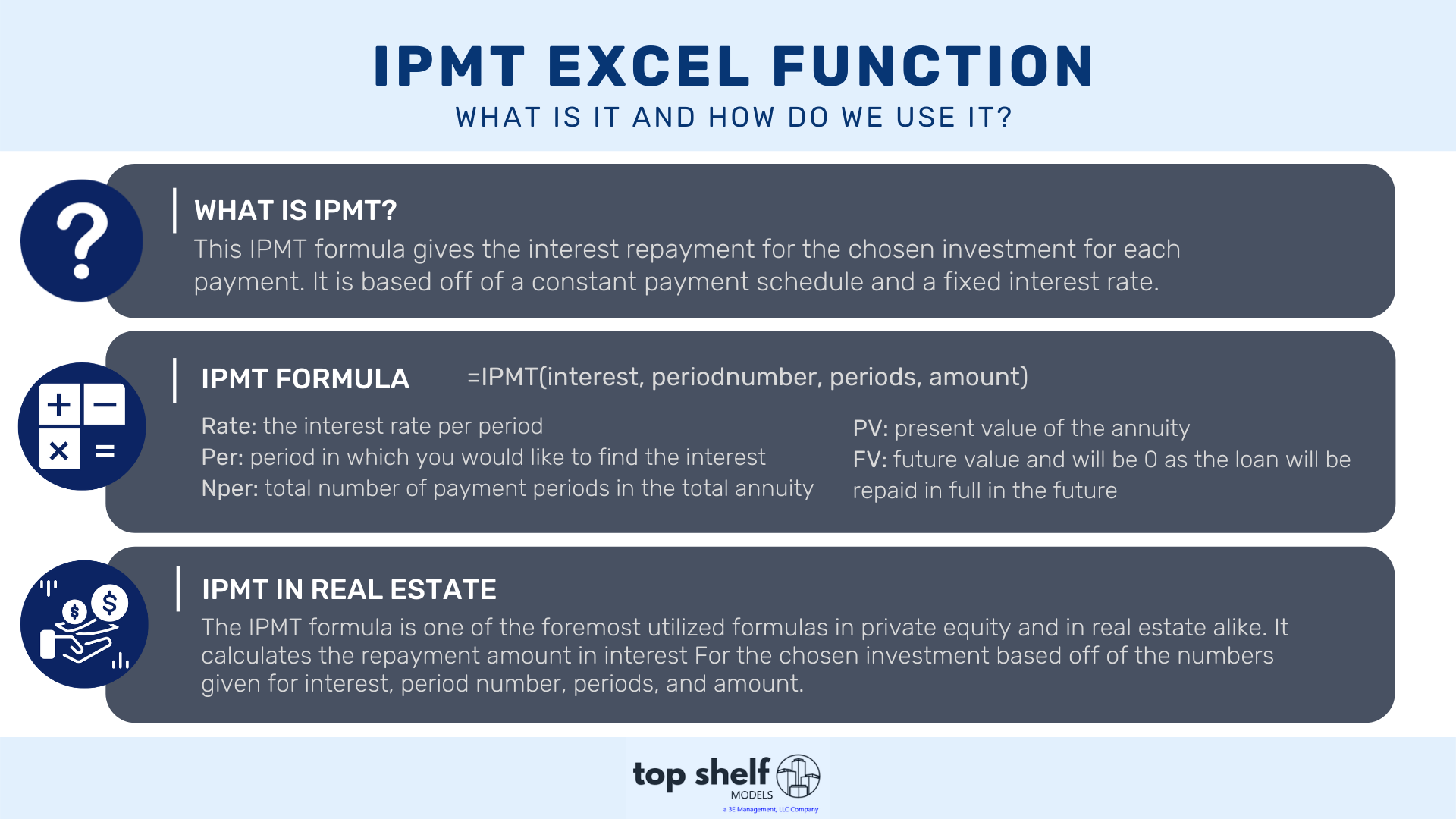

The IPMT formula is one of the foremost utilized formulas in private equity and in real estate alike. It calculates the repayment amount in interest for the chosen investment based off of the numbers given for interest, period number, periods, and amount. There are two errors that are common when utilizing the IPMT formula, #NUM! and #VALUE! #NUM! will occur if the value for the PER value is either 0 or less than the NPER amount. The #VALUE! error will occur when any of the arguments given are non-numeric in nature. Overall, if you need to find interest payments in a private equity setting or in a real estate model IPMT is the function to use.