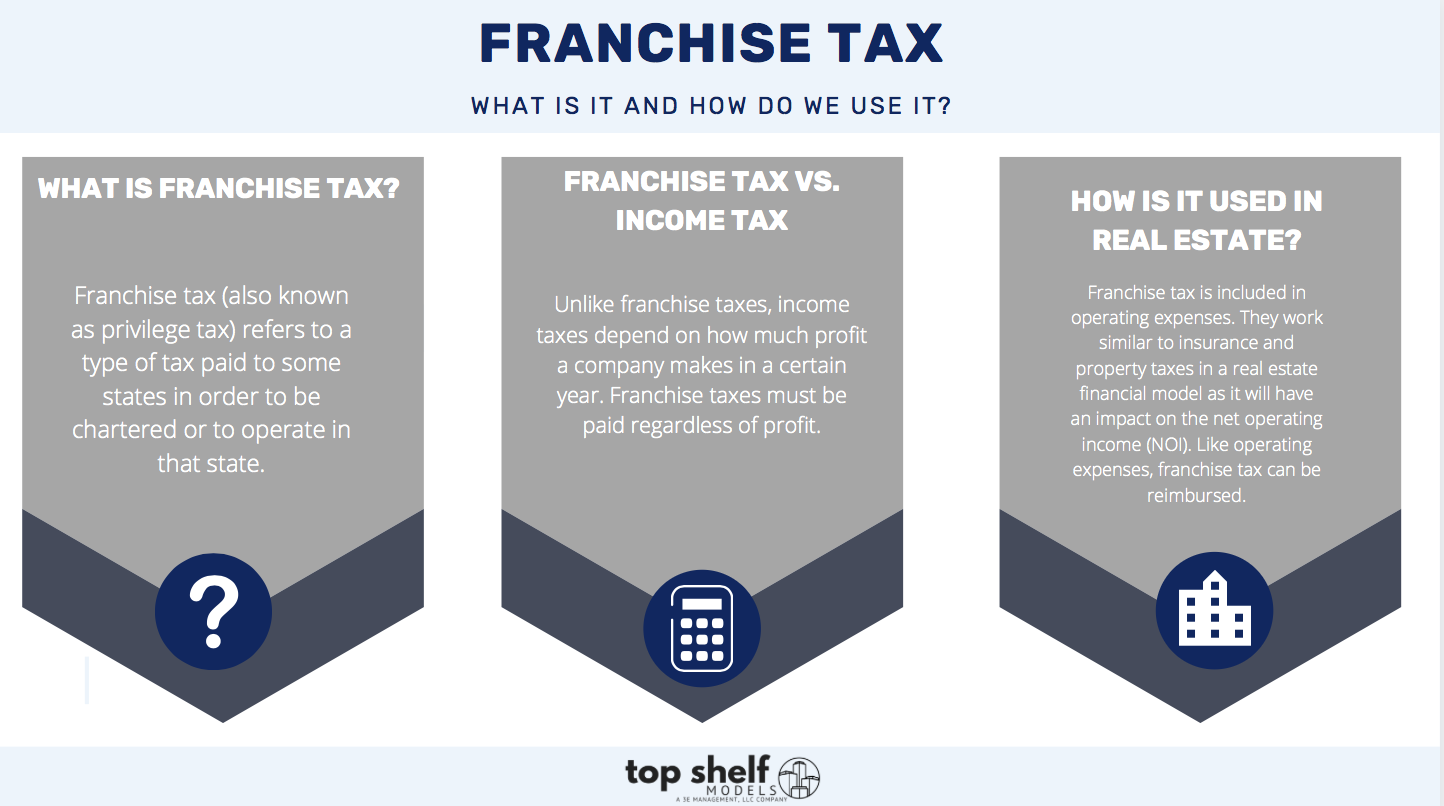

Franchise vs. Income Tax

Unlike franchise taxes, income taxes depend on how much profit a company makes in a certain year. Franchise taxes must be paid regardless of profit. The amount of franchise tax needed to be paid varies depending on the tax rules of the state. For example, some states may calculate it based on assets or net worth, while others may calculate based on the value of the company’s capital stock.

In addition, income tax payments are required from all corporations that bring in income from sources in the state, regardless of whether they conduct business there or not. “Conducting business” may be defined differently based on the individual state and some other factors they depend on include employees, physical presence, etc.