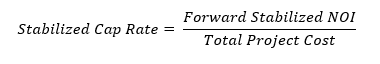

The difference between the two formulas for acquisition and development going-in cap rate is due to how the properties are initially leased. The going-in cap rate for an existing property is determined by the already pre-existing cash flows, whereas in a development, the buyer is creating a cash flow that did not previously exist.

Why is the Going-In Cap Rate important?

The going-in cap rate is significant because it helps investors assess real estate based on a project’s current value and net operating income. Typically, real estate investments trade at cap rates between 5 and 10 percent depending on geography, property type, and many other factors. Investors usually do not enjoy seeing what is called “cap rate compression”. Cap rate compression is the comparison between the going-in cap rate and the exit cap rate. If the exit cap rate is lower than the going-in cap rate, this is referred to as cap rate compression. Basically, this is implying that the property, assuming no change to NOI, will be valued higher at the exit just based on a lower cap rate. If your investment assumes cap rate compression, it will be viewed as riskier and will sometimes downplay the value you are creating through the operations of the investment.

How could the Going-in Cap Rate be misleading?

For an acquisition, the going-in cap rate could be misleading for a number of reasons. First, there could be vacancy in the asset which understates the NOI, or conversely, tenants that are about to vacate. Second, there could be free rent that understates the NOI. Third, higher going-in cap rates do not always mean a good investment because it could be a riskier asset or be subject to a lease that is expiring soon.