Millage Rate in Real Estate

Millage Rate

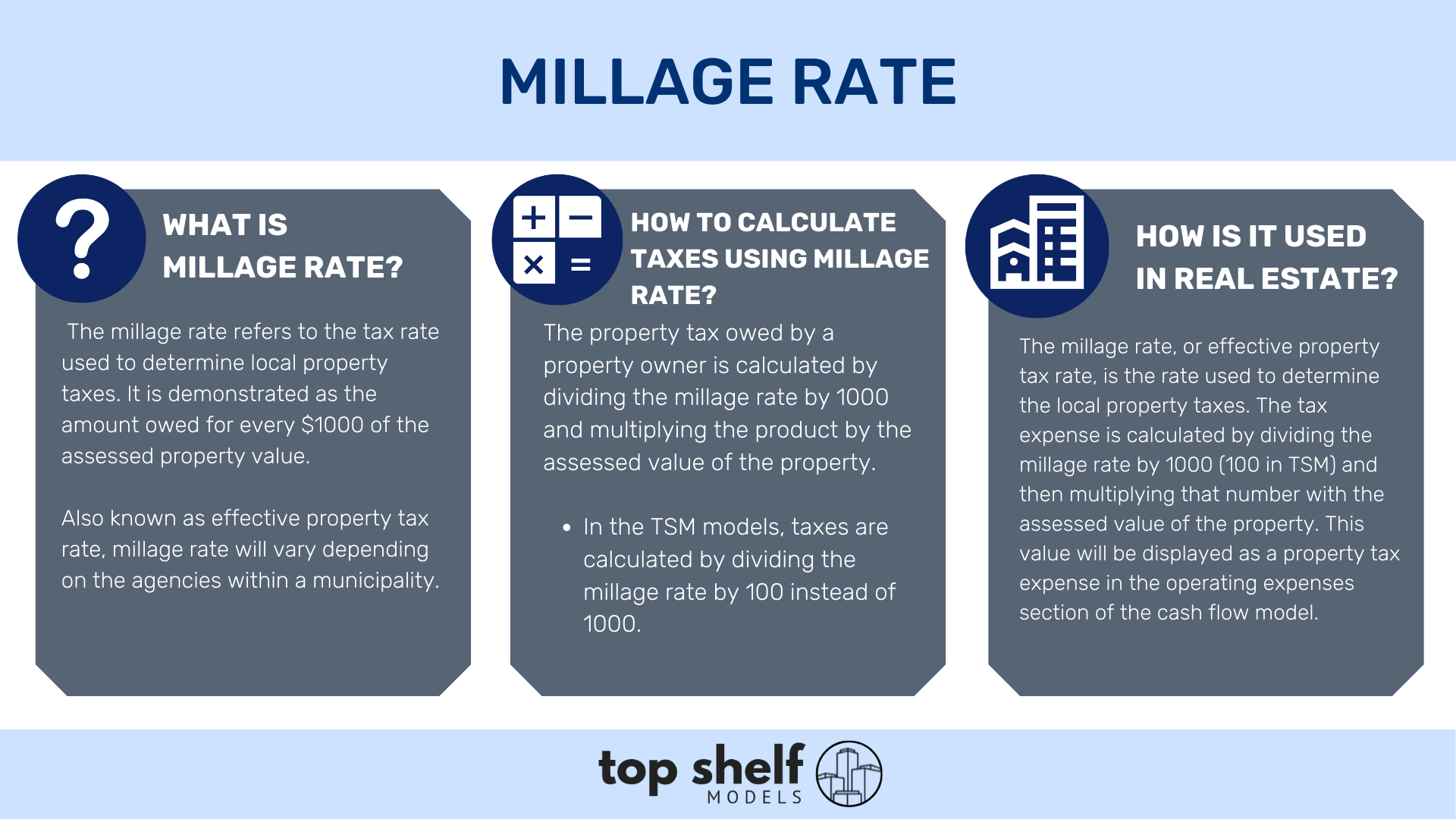

The millage rate refers to the tax rate used to determine local property taxes. It is demonstrated as the amount owed for every $1000 of the assessed property value.

Assessed Value – Value of a property for tax reasons. Assessed value takes into consideration: comparable sales, location data, inspections, and other factors.

Also known as effective property tax rate, millage rate will vary depending on the agencies within a municipality. However, property taxes are originally set by local governments and paid for by property owners. These tax values are based off a percentage of the property’s value – accounting for both the building and land.

How to Calculate Taxes Using the Millage Rate

The property tax owed by a property owner is calculated by dividing the millage rate by 1000 and multiplying the product by the assessed value of the property.

For example: assume a property had an assessed value of $100, 000. With a millage rate of 6, the tax payable in this instance equal to (6/1000) x 100,000 = $600.

In the TSM models, taxes are calculated by dividing the millage rate by 100 instead of 1000. See Below