What Are Operating Expenses?

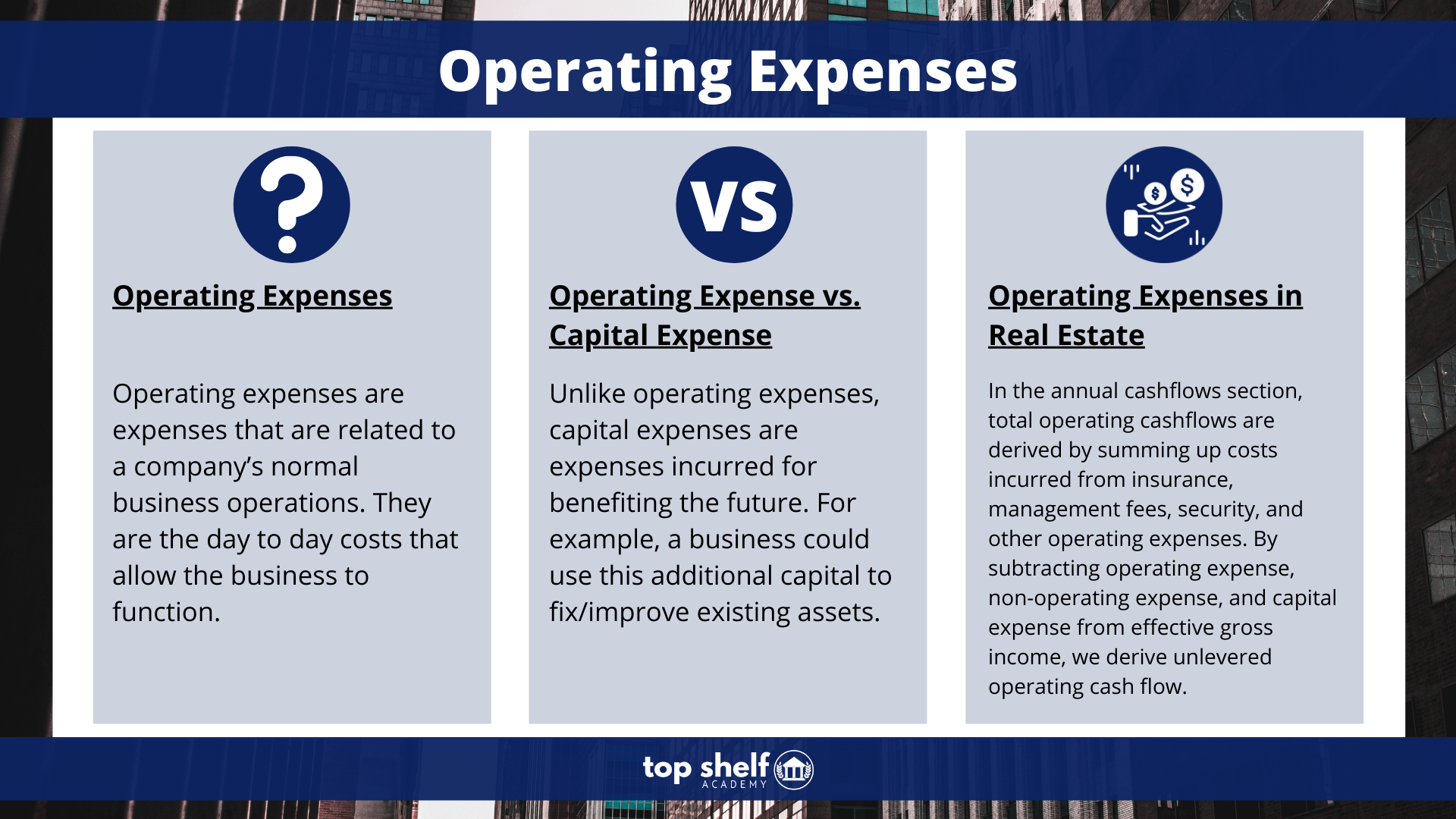

Operating expenses are expenses that are related to a company’s normal business operations. They are the day to day costs that allow the business to function. In real estate, these could include real estate taxes, management fees, property insurance, maintenance fees, repair fees, utilities, and other cash expenditures required to operate the property.

Operating expenses are an important part of the calculations used to derive Net Operating Income (NOI). NOI is used to analyze the profitability of income generating real estate investments.