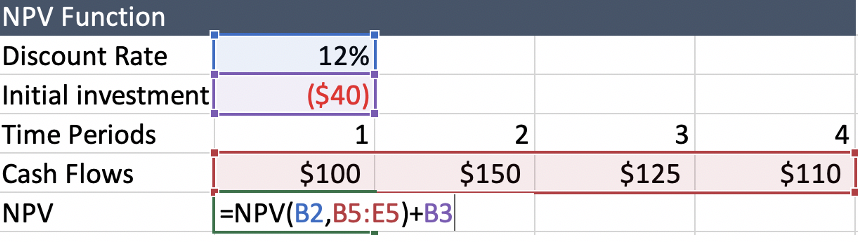

How is NPV Calculated?

In Excel, NPV is calculated utilizing the given discount rate and the series cash flow. The series cash flow must be inputted into consecutive cells, it will depict a cash flow over a series of consecutive days, months, or years. Below is how Excel will ask you to input the information, you must also add back the initial investment after the parentheses close.