Values: a series of cash flows that correspond to a schedule of payments in dates. Cash flows are discounted based on a 365-day year. Investments are displayed as negative numbers, while distributions displayed as positive numbers. Values is a required parameter.

Dates: a schedule of payment dates that corresponds to the cash flow payments. Dates must be entered in Date Excel format, or using the Date Excel function. Dates is a required parameter.

Guess: a number you guess will be close to the IRR. Guess is an optional parameter and is typically not needed unless the calculation results in a severely negative number, where you may need to change the guess from 0 to -0.1 If the IRR results in a 0.00%, you should double check the guess to make sure it is calculating correctly and not returning 0.00% as an error.

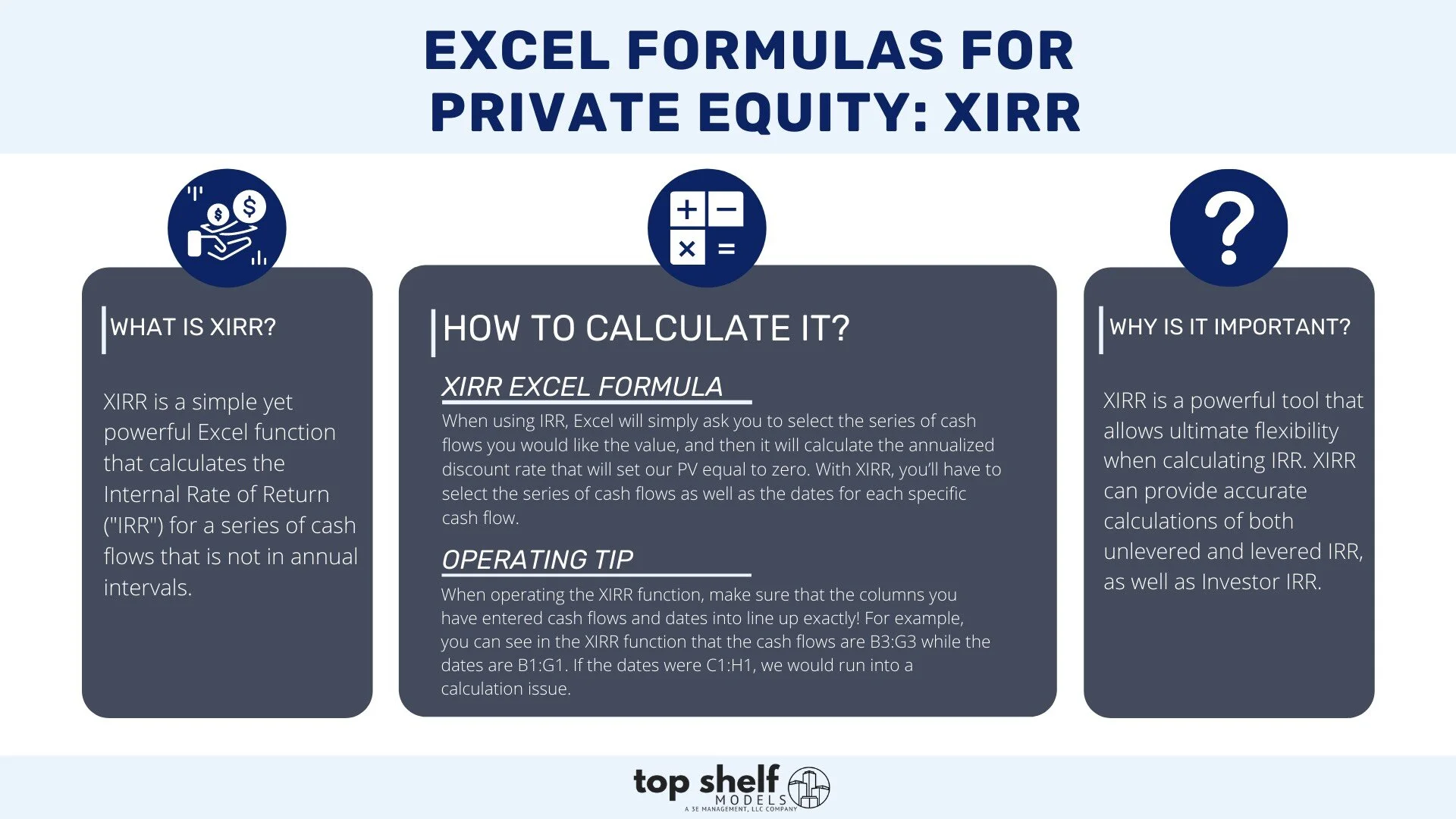

Operating tip: When operating the XIRR function, make sure that the columns you have entered cash flows and dates into line up exactly! For example, you can see in the XIRR function that the cash flows are B3:G3 while the dates are B1:G1. If the dates were C1:H1, we would run into a calculation issue.