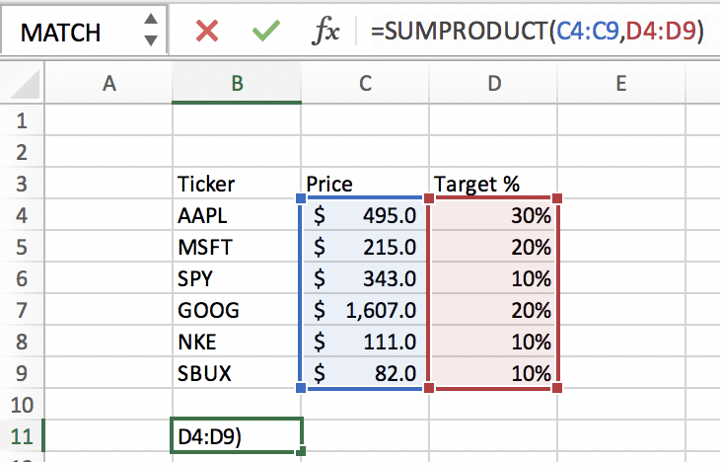

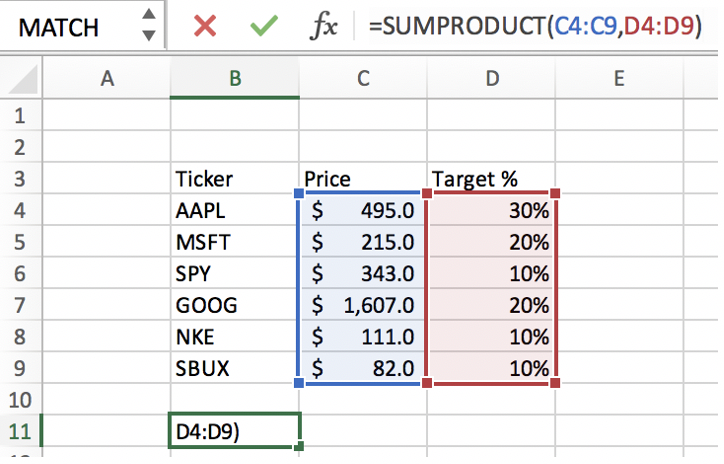

=SUMPRODUCT(array1,array2,array3,…)

Array1: the first array of numbers you want to multiply and then sum together. This is typically the values that you will be multiplying by the weights. This is a required parameter.

Array2,Array3,…: Arrays 2 through 255 are the other arrays that you want to multiply and then sum together with the first array. Think of these arrays as Array 1 multiplied by Array 2 multiplied by Array 3, and so on. This is an optional parameter, but you will need to enter in at least a second array in order to calculate a weighted average.

Operating tip: When inputting arrays into the SUMPRODUCT function, the arrays must have the same dimensions to be multiplied together. For example, SUMPRODUCT(A2:A10, B2:B5) will return an error.

=SUM(number1,number2,number3,…)

Number1: the first number you want to add. This can be a single value (i.e. B5), or a range of numbers (i.e. B5:B10). This is a required parameter.

Number 2,Number3,…: The second number or range of numbers you would like to add. This parameter is optional.