What is Preferred Return and How to Calculate It?

What is Preferred Return?

Preferred Return, often called ‘pref’, is a minimum return that Limited Partners in a fund must receive before any carried interest can be distributed to General Partners. A preferred return is expressed as an annual rate of return and can be thought of as the minimum expected return for the investment.

Limited Partners will receive 100% of their gross distributions until they have reached a certain rate of return on their investment in the fund. Once this rate of return has been met, General Partners will start to earn carried interest.

How is Preferred Return calculated?

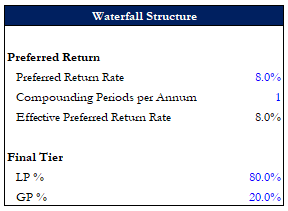

Each Fund’s Preferred Return calculations are defined by the Limited Partnership Agreement that governs the fund. Fund’s calculations can vary in several ways. The most common variations are in the compounding periods of the preferred return rate, and the method for calculating elapsed time between periods.

For example, Fund A might specify that preferred return on any given capital call starts accruing when the call is funded and stop accruing when the applicable distribution of preferred return is made. Fund B might specify that for preferred return calculation purposes, any capital call or distribution is said to have taken place on the last day of the calendar month in which the capital call or distribution occurred. Now imagine a scenario where both Funds call capital on January 1, 2020 and distribute proceeds on December 31, 2020. In this scenario, Fund A investors are receiving preferred return based on 365 days of accrual, while Fund B investors are only receiving 335 days of accrual since the capital call is considered on the last day of the month.

EXAMPLE:

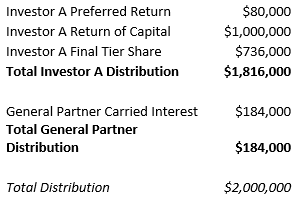

Investor A contributes $1MM into Real Estate Fund 1, LLC on December 31st, 2020. On December 31st, 2021, Real Estate Fund 1, LLC announces a distribution. Investor A’s gross share of the distributable proceeds is $2MM. Assuming the following structure, what Investor A’s preferred return, and total distributions?

Step 1: Calculate Preferred Return Owed

Investor A contributed $1MM 365 days prior to the distribution. To calculate preferred return, we use the following formula:

Contribution * (1+R)^(#Days/365)

R= Preferred Rate of return, in our case 8%

#Days = 365 (12/31/21-12/31/20 = 365 DAYS)

Contribution = $1MM