Sources and Uses

Sources and Uses

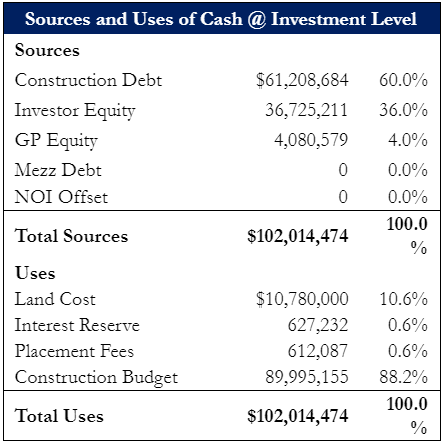

The Sources and Uses table is integral in real estate to provide a high-level overview of the transaction. There is a lot of confusion about how to prepare this table, why it’s needed, and which amounts go where.

What are the Sources and Uses of Funds?

The Sources and Uses of Funds is outlined in a Sources and Uses Statement. A Sources and Uses statement shows how the different layers of financing are being used to fund the acquisition/development of a transaction (sources), and what those funds will be used for (uses). The total sources and uses must be equal to each other (all the money has to go somewhere).

An example sources and uses table is shown below:

Sources and Uses of Cash – Development

Sources

Debt – Construction debt, Senior debt, mezzanine debt, etc. This is the amount of debt funded by the lender that is being used in the investment. It is important to not double count debt if one loan is used to pay off another loan. As you can see above, we are showing the Construction Debt but do not show the Permanent/Senior Debt that paid off the Construction Debt.

NOI Offset – Any positive NOI generated before reaching peak capitalization that can be used to offset concurrent uses of capital.

Equity – Determined by subtracting debt and NOI offset from the total sources of capital. This is the amount of equity or capital that is contributed by the investors and should be found throughout the model. Can further be split into General Partner/Developer Equity and Limited Partner/Investor Equity.

Development Cost

Determine the land acquisition cost and the total development cost.

Other Uses

Fees/Transaction Costs – fees/costs incurred as a result of the development that are not included in the development budget (e.g. placement fees).

Construction Interest Reserve – Interest expense incurred during construction/development of the real estate asset that is included in the debt financing.

Sources and Uses of Cash – Acquisition

Sources

Debt – Senior debt, mezzanine debt, etc. This is the amount of debt funded by the lender that is being used in the investment. It is important to not double count debt if one loan is used to pay off another loan.

NOI Offset – Any positive NOI generated before reaching peak capitalization that can be used to offset concurrent uses of capital.

Equity – Determined by subtracting debt and NOI offset from the total sources of capital. This is the amount of equity or capital that is contributed by the investors and should be found throughout the model. Can further be split into General Partner and Limited Partner/Investor Equity.

Acquisition Cost

Determine the acquisition cost and the renovation costs (if any).

Other Uses

Fees/Transaction Costs – fees/costs incurred as a result of the acquisition that are not included in the total budget (e.g. placement fees).