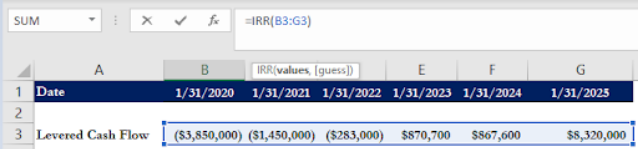

=IRR (values, [guess])

Values: The Values parameter is required and is the cash flows invested and distributed for the investment. Investments are displayed as negative numbers, while distributions are displayed as positive numbers.

Guess: The guess parameter is optional and usually is not needed. By default, the guess is .1 or 10% if not entered, and the calculation will run up to 20 iterative calculation cycles until an answer is reached. If you have a large negative result, you may need to change the guess to -0.1. Also, sometimes there can be multiple correct IRR answers so the guess helps Excel find the most correct result.

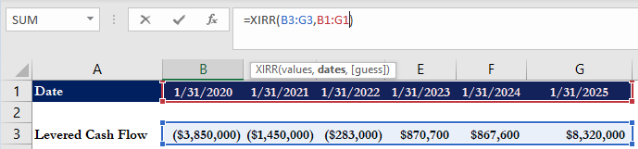

XIRR Formula