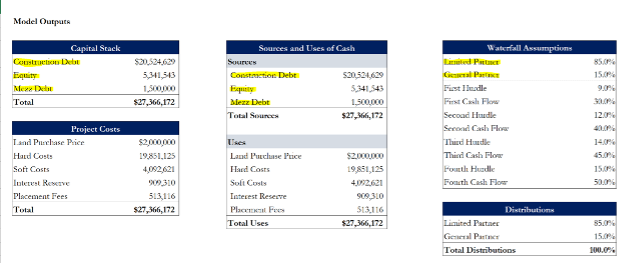

In the waterfall section of the model, we can see that the limited partners provided $4,674,287 and the general partners provided $824,874 to fund the equity portion of this project.

This ties back to the model outputs above that states the equity capital is funded 85% by LP and 15% by GP. This covers the $5,341,543 total equity funding needed.

Total Budget – Construction Debt – Mezzanine = Equity

$27,366,172 - $20,524,629 - $1,500,000 = $5,341,543